Or, if using Excel, the break-even point can be calculated using the “Goal Seek” function.

Statistics and Analysis Calculators

He wants to know what kind of impact this new drink will have on the company’s finances. So, he decides to calculate the break-even point, so that he and his management team can determine whether this new product will be worth the investment. As with most business role of perception in consumer behavior calculations, it’s quite common that different people have different needs. For example, your break-even point formula might need to be accommodate costs that work in a different way (you get a bulk discount or fixed costs jump at certain intervals).

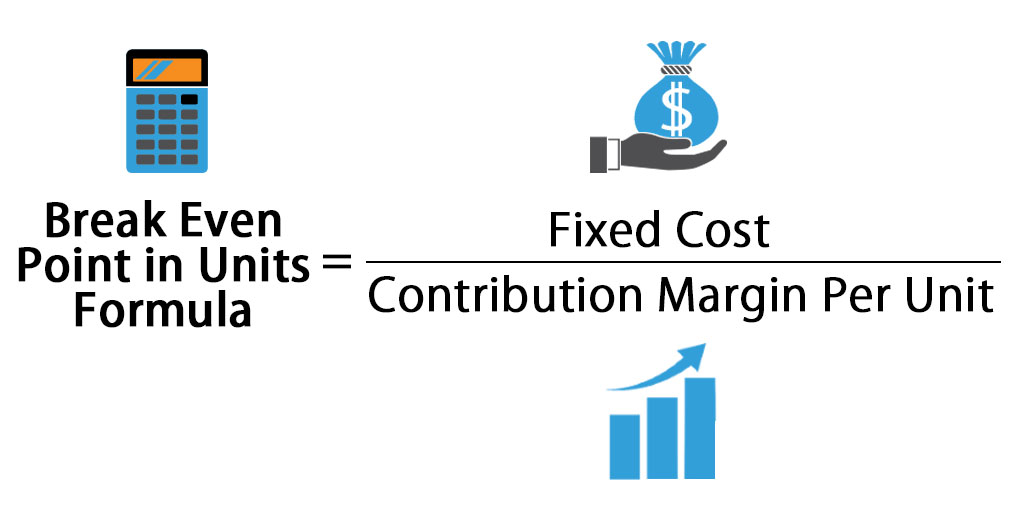

Break-even point formula

Break-even analysis formulas can help you compare different pricing strategies. While gathering the information you need to calculate your break-even point is tricky and time consuming, you don’t have to crunch the numbers with just a pen and paper. Any number of free online break-even point calculators can help, like this calculator by the National Association for the Self-Employed. Like a lot of supposedly simple accounting principles, the break-even point is a little harder to understand than it initially appears. Let’s dive into how to calculate your break-even point and how it can guide your business.

- If the stock is trading at $190 per share, the call owner buys Apple at $170 and sells the securities at the $190 market price.

- Note that in this formula, fixed costs are stated as a total of all overhead for the firm, whereas price and variable costs are stated as per unit costs—the price for each product unit sold.

- We provide simple, predictable pricing to keep your break-even point analysis accurate and up to date.

- Many products cost more to make than the revenues they generate.

- The price of goods sold at fluctuates, and the cost of raw materials may hardly stay stable.

Calculating Contribution Margin and BEPs

Determine the break-even point in sales by finding your contribution margin ratio. Once you calculate your break-even point, you can determine how many products you need to manufacture and sell to make your business profitable. The break-even point is the number of units that you must sell in order to make a profit of zero. You can use this calculator to determine the number of units required to break even.

The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even analysis to measure its repayment of debt or how long that repayment will take. The basic objective of break-even point analysis is to ascertain the number of units of products that must be sold for the company to operate without loss.

Fixed costs are expenses that remain the same, regardless of how many sales you make. These are the expenses you pay to run your business, such as rent and insurance. At this point, you need to ask yourself whether your current plan is realistic or whether you need to raise prices, find a way to cut costs, or both. You should also consider whether your products will be successful on the market.

Variable Costs per Unit- Variable costs are costs directly tied to the production of a product, like labor hired to make that product, or materials used. Variable costs often fluctuate, and are typically a company’s largest expense. Our partners cannot pay us to guarantee favorable reviews of their products or services. Want software that can help you calculate your break-even point? Check out our piece on the best bookkeeping software for small-business owners.

Below, we’ll cover everything you need to know about break-even point to calculate your own (with a simple formula) and use it to guide your business toward smarter decisions. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.