Sales below the break-even point mean a loss, while any sales made above the break-even point lead to profits. Notice how the calculator automatically calculates the cumulative how to successfully manage culture change in the workplace cost total. If you entered the average price per trip and entered all your expenses as expenses per week, for you, the BEP is the number of trips you must make per week.

How to Calculate Break-Even Point (BEP)

You are also eligible for tax deductions on the interest paid on your loan. On the other hand, buying the equipment may entail a hefty down payment. As mentioned earlier, determining your BEP can help you secure loans or persuade investors for your business. There are many various types of small business loans entrepreneurs can look into.

Break-even formula

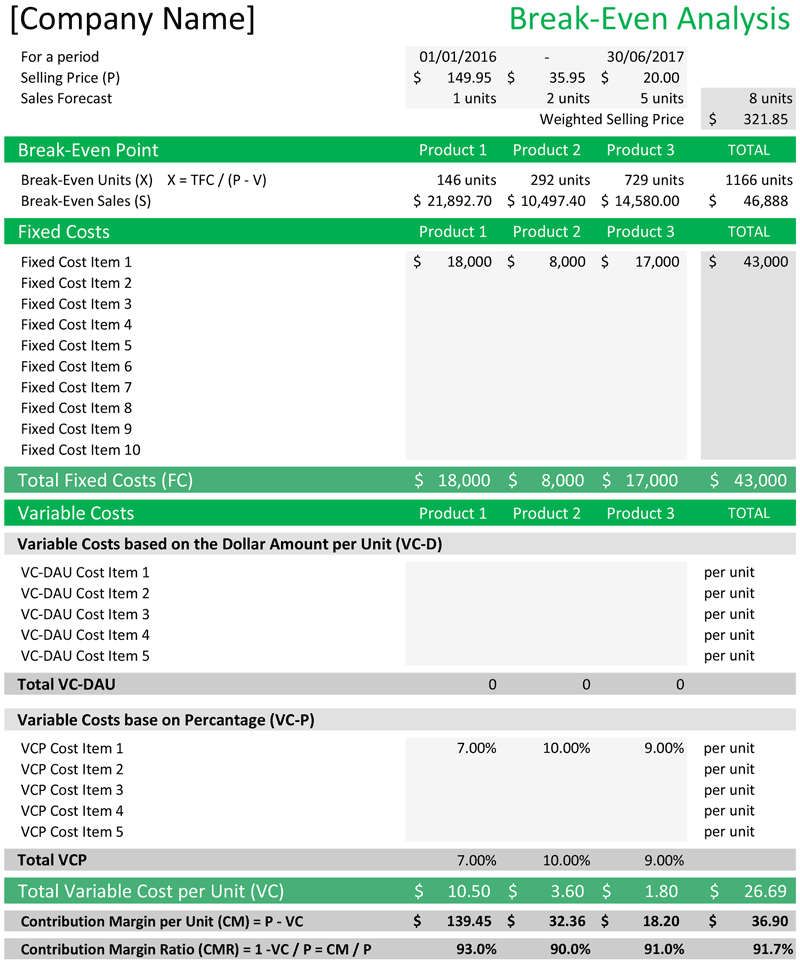

Once Company A sells over 500,000 units, that’s when it will earn profits. The break-even point is the sales level at which total revenues equal total costs, meaning the business neither makes a profit nor incurs a loss. It’s a crucial metric for business owners to determine how many units of a product or services they need to sell to cover all their costs. Our guide will discuss the fundamentals of the break even point and how to calculate this financial benchmark.

Benefits of break-even analysis

To reduce BPE and recoup expenses sooner, it helps to cut costs on fixed and variable expenses. Things like looking for an affordable office or warehouse to rent will decrease BPE. If you can find a supplier with a good deal on raw materials, it can also lower your BPE. Achieving a competitive price and upgrading the quality of your product will also boost sales, therefore reducing BPE. It’s a useful reference point that helps strategically price your products. Fixed costs are costs that do not change based on your production or sales volume (e.g., rent, insurance, and salaries).

Any number of free online break-even point calculators can help, like this calculator by the National Association for the Self-Employed. The break-even formula in sales dollars is calculated by multiplying the price of each unit by the answer from our first equation. The difference between a business that sells a service versus one that manufactures or resells a product is, a manufacturer or reseller has component costs.

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. If a company has reached its break-even point, the company is operating at neither a net loss nor a net gain (i.e. “broken even”). The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

It’s one of the biggest questions you need to answer when you’re starting a business. There are two main business factors that impact BPE, these are fixed costs and variable costs. The fixed costs refer to necessary expenses such as rent or mortgage payments, utilities, marketing, research and development, etc. These are essential operational expenses that keep your business afloat even when you’re not producing goods.

You can also check out our markup calculator and margin calculator. A break-even analysis allows you to determine your break-even point. Once you crunch the numbers, you might find that you have to sell a lot more products than you realized to break even. According to this formula, your break-even point will be $200,000 in sales revenue. This analysis shows that any money generated over $200,000 will be net profit. Once you’ve decided whether you want to find your break-even point in sales dollars or units, you can then begin your analysis.

- That’s the difference between the number of units required to meet a profit goal and the required units that must be sold to cover the expenses.

- The break-even point is the sales level at which total revenues equal total costs, meaning the business neither makes a profit nor incurs a loss.

- And these days, your town’s business group may even run their own active social media page.

- Ads and marketing can take a considerable chunk from your revenue.

- You might need to look for a more affordable space to rent, or rethink a more cost-effective marketing strategy.

- Another way to elevate your brand it to improve your reputation.

Using the algebraic method, we can also identify the break-even point in unit or dollar terms, as illustrated below. The point being is, what the break-even point analysis means depends on how you entered the numbers. On the other hand, you may decide to enter your average income per day, and then your BEP will be the number of days you need to drive.

You buy hotdog rolls in packages of a dozen, and the hotdogs in boxes of forty-eight. You should not enter the total cost of a package of rolls and a package of hotdogs. Instead, you should enter the cost of an individual roll and a single hotdog.

It’s ideal for business owners that have good credit and are looking to expand their company. Besides donating, take part in actual events these charities hold. If you’re advocating for environmental causes, you can participate as a sponsor at a non-profit event.